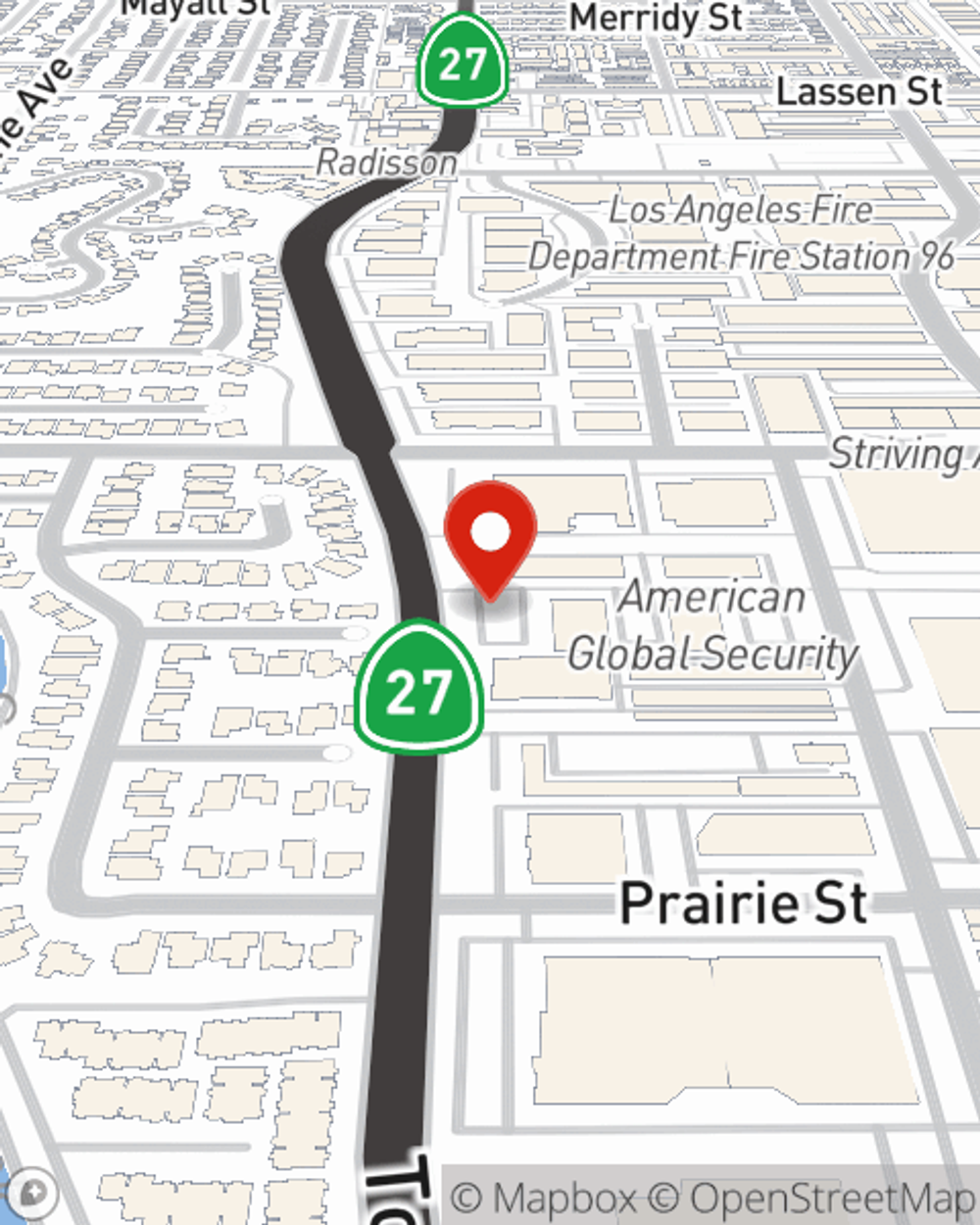

Business Insurance in and around Chatsworth

Looking for small business insurance coverage?

Cover all the bases for your small business

Your Search For Excellent Small Business Insurance Ends Now.

Running a small business requires much from you. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, trades, contractors and more!

Looking for small business insurance coverage?

Cover all the bases for your small business

Cover Your Business Assets

Every small business is unique and faces a different set of challenges. Whether you are growing a candy store or a shoe store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your space, you may need more than just business property insurance. State Farm Agent Jeff Marduce can help with a surety or fidelity bond as well as commercial auto insurance.

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Jeff Marduce's team to discuss the options specifically available to you!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Jeff Marduce

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.